The Dow Theory

Dow Theory is a creation of Charles H. Dow, founder and editor of The Wall Street Journal. After his death, Dow Theory has been represented by William Hamilton, Robert Rhea and E. George Schaefer.

The Basics of Dow Theory

Dow Theory is a method of analyzing and explaining stock market trends and long-term cycles. According to the Dow Theory, three market forces are determining every stock-market movement:

(1) Master Trends

(2) Secondary Reactions

(3) Daily Fluctuations

A short analysis of these three (3) forces:

(1) Primary Trends

The Primary, or else Master Trend, reflects the long-term trend of the market which is either bullish or bearish. The bullish trends usually last longer (7-8 years) and the bearish trends are more intense (last 1-2 years).

(2) Secondary Reactions or Medium-Swings

For limited periods, the market can move away from its primary direction. These movements are called Secondary Directions. These ‘reactions’ of the market usually last from a couple of weeks to 3 months. A secondary reaction generally retraces from 1/3 to 2/3 of the primary price change since the previous secondary reaction.

(i) In the case of a bearish market, a secondary reaction is called a ‘bear-market rally’

(ii) In the case of a bull market, a secondary reaction is called a ‘bull-market correction’

(3) Daily Fluctuations or Short-Swing

Daily fluctuations correspond to chaotic daily market movements which may last from a couple of hours to several days. These fluctuations are chaotic and thus they are unpredictable.

The Dow Theory Basic Mechanisms

The Dow Theory aims to signal changes in the primary market direction and to achieve that mission, it uses two popular stock-market averages, DJIA (Dow Jones Industrial) and DJTA (Dow Jones Transportation).

(i) If one of these two indices changes its master trend, then this movement is evaluated as a secondary trend.

(ii) If both indices change their master trend, then the master trend of the market is considered as changed.

How can we define the Change of the Primary Trend?

Many methods can be used to distinguish a Bull from a Bear market. For example, many analysts use the 200-day Moving Average. If the market is above its 200-day MA then it is considered bullish, and if it trades below its 200-day MA it is considered bearish. Numerous other methods can be applied.

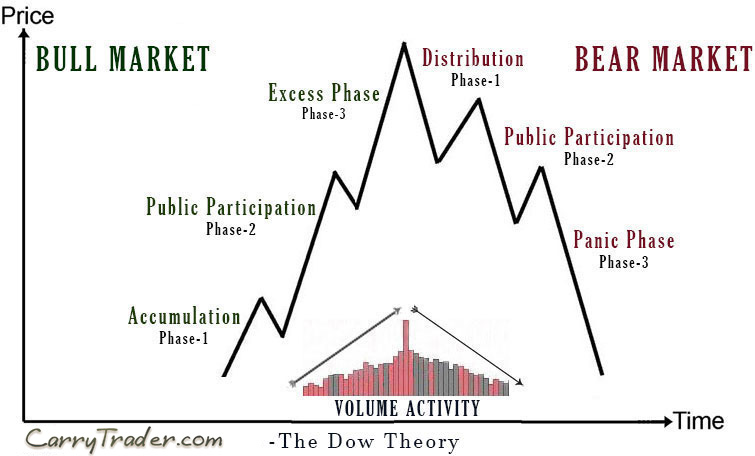

Stock-Market Trends and their Phases

The market trends are evolving in three (3) phases, three for bullish trends and three for bearish trends:

BULLISH TRENDS (↑)

(i) Accumulation (Phase-1)

During the accumulation phase, the ‘smart money’ buys or sells stocks against the general market sentiment. Therefore, the demand deriving from ‘smart money’ equals the supply from retail investors, and prices tend to accumulate, remaining unchanged. During this phase, the market usually ranges between a Master Support and Resistance level. In addition, the volume of activity is usually considerably limited.

(ii) Public Participation (Phase-2)

A strong trend is formed as retail investors eventually start to follow the ‘smart money’. The previous range is abandoned, and a Trending Market emerges. This phase continues until speculators decide to capitalize on some of their profits. During this phase, the volume activity and volatility are booming.

(iii) The Excess Phase (Phase-3)

Excessive optimism and greed are moving stock-market prices at very high levels. As stocks are now expensive in terms of fundamentals (P/E, P/Bv, etc.), the ‘smart money’ capitalizes profits by scaling back positions. Volume activity is very high, but usually, volatility is limited.

BEARISH TRENDS

(i) The Distribution Phase (Phase-1)

This is the first phase of the new bear-market trend. This phase is the exact opposite of the accumulation phase-1 of a bull market trend. The smart money now sells aggressively in the market. Prices are falling but they don’t tank as many retail investors remain optimistic regarding the master trend. During the first few days of phase-1, the volume activity is booming.

(ii) Public Participation (Phase-2)

As retail investors realize that the business conditions are getting worse they want now to sell the market. The smart money continues to sell stocks and remains long only on stocks with an exceptional long-term fundamental outlook. Prices are falling fast but panic is not yet seen, as retail investors anticipate they will have better chances to sell the market. Volume activity is shrinking as there are many sellers and only a few buyers (speculators).

(iii) The Panic Phase (Phase-3)

This last phase of the bear market is characterized by pure panic. Everyone wants to exit the market at any available price (sell-off). As cash becomes king, prices tank. The newspapers worsen things as ‘Blood in the Street News’ sells a lot now. The smart money does not sell, during this phase, on the contrary, it opens selectively long positions.

Chart: Dow Theory and the Bull and Bear Market Trends

Six (6) Basic Dow Theory Axioms

These are the six (6) axioms of the Dow Theory:

- Stock market prices discount all news

The prices of stocks instantly discount any new information when it becomes available in the market. Therefore, speculation which is based exclusively on the already-released news is impossible. Note, that this axiom is also one of the basic axioms of technical analysis.

- Stock-market follows three (3) Movements

As it was explained before: the master trend, the secondary trend, and the daily fluctuations

- Market Trends have three (3) phases

As it was presented before: Bullish Trends, (i) Accumulation phase, (ii) Public participation, and (iii) Excess Phase, and Bearish Trends, (i) Distribution phase, (ii) Public participation, and (iii) Panic Phase

- Trends exist until signals prove that they have ended

Stock markets may temporarily change their direction, opposite to the master trend, but unless there are definite signals for a master trend reversal, they will soon resume the prior move.

- Stock market averages must confirm each other

As explained before, the trend of DJIA (Dow Jones Industrial) and the DJTA (Dow Jones Transportation) must confirm each other. This is explained as the DJIA reflects the manufacturing activity and DJTA reflects transportation. These two industries are linked, as the orders of the first (manufacturing) become the revenue of the other (transportation). These two averages should move in the same direction to confirm the change in the Primary Trend.

- Trends are confirmed by volume

Dow argued that if price activity is accompanied by high volume, it represents a ‘true market view’. Therefore, volume activity can confirm a developing trend.

Compare Brokers offering Equity Trading

|

STOCK-BROKER |

COMPANY |

PLATFORMS |

ACCOUNT |

VISIT |

|

|

|

ONLINE PLATFORMS □ MetaTrader4 □ MetaTrader5 □ cTrader □ FIX API □ Mobile Traders Trading Stocks, Indices, Forex and Commodities |

|

MORE ON CARRYTRADER

| ■ COMPARE PROVIDERS | ► Brokers for Carry Traders | |||||

| ■ FOREX RESOURCES | » Currency indices | » Currency Pairs | » Forex Fundamentals | » Trading Naked Charts & Strategies | ||

| ■ OTHER RESOURCES | » CBOE Indices | » Famous Investors |

■ Dow Theory

by George Protonotarios for CarryTrader.com (c)