CONTRARIAN TRADING

The general goal of a Contrarian Trader is to buy under-performing assets and to sell over-performing assets.

What is the Contrarian Trading?

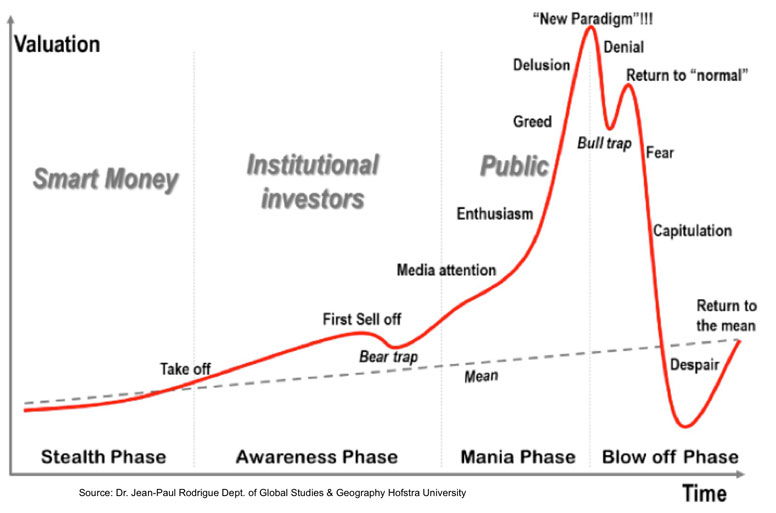

Contrarian Trading means betting on the opposite side of the prevailing market trend. A contrarian trader is based on the belief that the mass is usually wrong about how the market is going to perform. In other words, he claims that the majority of traders tend to buy the market at its peak or to sell the market at its bottom. For all those experienced with trading, this is not far from reality.

What is the goal of a Contrarian Trader?

The general goal of a Contrarian Trader is to buy underperforming assets and to sell over-performing assets. Given neutral news most of the times the under-performing assets will go up and the over-performing assets will go down.

Contrarian Strategy and Forex Trading

When a trader opens a long/short position in the Forex market forecasts that more traders will be tempted to open positions in the same direction in the near future. But the market is not driven by retail traders it is driven by major institutional traders. Retail traders tend to open positions that are not followed by institutional traders. Institutional traders tend to trade against the masses. So the key for a contrarian trader is to think like an institutional player, not a retail one. But let’s see a broader approach to the contrarian strategy.

Going the other Way of the Diminishing Demand

If most market participants believe that the price of an asset will rise then they already bought that asset. At a certain point, the demand equals the supply. After that point, the demand is diminishing while the supply remains stable so the price of this asset will consequently fell. This situation is particularly true after a news release. Contrarian traders are using a wide selection of market sentiment indicators to define how the mass is trading. Below in this article, you can find a list of market sentiment tools and indicators.

The Human Psychology

Our human nature is based on prehistoric instincts, fear and greed are two of them. Traders have the tendency to become greed at the peak of the market and to be feared close to the market’s bottom.

◙ Buy when other traders are feeling fear and sell when other traders are greed

Baron Rothschild sometime said "The time to buy is when there's blood in the streets".

Essential information when applying the contrarian trading strategy

A contrarian trading strategy doesn’t mean trading against the master trend. On the contrary, you should constantly follow the trend. The best time to apply the contrarian trading strategy is when:

◙ At times when the market sentiment is opposite to the master trend

This means a bullish market sentiment on a bearish master trend or a bearish market sentiment on a bullish master trend. In both cases, you should trade against the market sentiment.

The Contrarian Trading Strategy is more Effective when Selling the Market

The great mass of traders is more willing to buy the market than to sell the market. There are even cultures around the globe that see short-selling as an unethical practice.

Fundamental Facts may enforce the efficiency of a Contrarian Trading Strategy

The valuation of any financial asset is based on fundamental facts and figures. This means that in the long-run the price of any financial traded asset tends to reflect the real value inside. This simple fact makes things easier.

◙ Buy assets when they are fundamentally undervalued and the great mass of traders is selling

◙ Sell assets when they are fundamentally overvalued and the great mass of traders is buying

Buy the Rumor and Sell the Event

Gurus usually say buy the rumor and sell the event. This is the exact meaning of the contrarian trading strategy.

◙ “Buy the rumor” as only a few traders will risk buying then -therefore the price is right

◙ “Sell the event” as the great majority of traders have already bought and therefore demand from this point and after will probably decrease

Contrarian Strategy General Sentiment Indicators

Here are some important indicators for determining the general market sentiment.

-

Put / Call Ratio - This is a ratio measuring the relationship between the volume of put and call options

-

Community Outlook –This is a tool by MyFxBook which shows the community positioning. It representing the positions of tens of thousands retail trading accounts » Visit here the Forex Community Outlook

-

The Commitment of Traders –This is a report issued by CFTC including the positions of Forex traders in the futures market. Find more information below and keep in mind that the retail traders are referred as Commercial Positions

-

Sentiment Surveys – There are several surveys measuring investor’s sentiment

-

Price Action –This is the most reliable sentiment indicator. Below you can find technical analysis tools used for the evaluation of the real price action

Commitment of Traders as an Indicator for applying the Contrarian Trading Strategy

The Commitments of Traders (COT) is an important indicator for Forex contrarian traders. The COT report is issued by the CFTC and shows the aggregated long and short positions in the futures market regarding Forex currency pairs. You may find the positions of retail traders referred as Commercial traders and use that figure as a retail market sentiment. The COT is also very important as concerns the positions of non-commercial traders. This is not a retail market sentiment this is a market sentiment deriving from the positions of professional traders, therefore, you don’t want to trade against it.

» CFTC General Commitments of Traders | » CME Group Currency Futures COT

Technical Analysis and Price Reversal Indication

These are some important technical analysis tools for identifying upcoming reversals.

◙ (Timeframes M15, M30, H1, H4, D1):

(1) Technical Analysis patterns

1.1 Head & Shoulders Top and Bottom Pattern

1.2 Cup & Handle Bullish Pattern

1.3 Double / Triple Top and Bottom Pattern

1.4 Rounding Top and Bottom Pattern

1.5 Symmetrical, Ascending and Descending Triangles

1.6 Flag and Pennant Short-Term Patterns

1.7 Breakout / False Breakout Patterns

(2) MACD Divergences (very important signals)

(3) Pivot Points when reached (very important as support and resistance)

(4) Major Support & Resistance Levels when reached

(5) Long-Term Trendlines when reached

These are some important short-term signals for reversals

◙ Timeframes M1, M5

(1) Spinning Top

(2) Pins

(3) Hammers

(4) Railway trucks

(5) RSI readings, above 70 or below 30 (M5 only)

Final Thoughts –Ideal Conditions for Applying the Contrarian Strategy

By summarizing all the above conditions we may conclude that the ideal contrarian trade occurs when:

(1) The great majority of retail traders (90%) trade in a particular direction. You should trade the other way

(2) The mass of traders is betting against the master trend. You should follow the master trend

(3) The COT analysis indicates that Non-Commercial traders are opening positions on the opposite side than Commercial Traders. Follow the Non-Commercial Traders

(4) When fundamentals indicate over-performing or under-performing markets. Follow the fundamentals

(5) When there are technical analysis signals indicating potential reversals (MACD divergence, strong support/resistance, long-term trend lines, patterns identification etc)

(6) When the Real Price Action indicates that the short-term trend is about to change (pins, hammers, railway trucks etc)

MORE ON CARRYTRADER

| ■ COMPARE PROVIDERS | ► Brokers for Carry Traders | ||||||

| ■ CURRENCY PAIRS | ► EURUSD | ► GBPUSD | ► USDJPY | ► EURGBP | ► AUDUSD | ► NZDUSD | ► USDCAD |

| ■ GLOBAL MARKETS | » Gold |

|

|

||||

| ■ LEARNING RESOURCES | » Currency indices | » CBOE Indices | » Forex Fundamentals | » The History of Interest Rates |

◙ Contrarian Forex Trading

by Giorgos Protonotarios, Financial Analyst

CarryTrader.com (c)