Learning

Introducing the Forex Rating Formula 4.1

Introducing the Forex Rating Formula 4.1

Mission: "Ensuring the safety of funds, by paying low transaction costs and by using state-of-the-art technology”

A Few Words About Online Ratings

In the digital world, end users choose providers by reading their reviews/ratings on the net. Unfortunately, based on statistics, more than half (50%) of these user ratings are fake. This is happening as online corporations have a huge commercial incentive to hire outsiders to produce favorable reviews for them and unfavorable reviews for all of their competitors. Evidence comes from the fact that most of these user reviews/ratings receive extreme values (i.e. 10/10 or 0/10). The Rating Formula 4.1 comes as an alternative solution for this problem. The Rating Formula 4.1 provides a stable, objective, and common environment to rate all major Financial Companies with precision.

The formula is based on a 4-factor mathematical model including the 4 major aspects of trading. It was introduced by TradingCenter.org and it is a concept of George M. Protonotarios.

» The Rating Formula on TradingCenter.org

The Four (4) Factors of Trading

There are four (4) factors incorporated in the rating formula. Each of these four factors includes several sub-factors as it is explained and analyzed later. The total of all factors combined equals a 100% rating.

Here are the four factors and their weight:

(A) Safety of Funds (Weight 26%)

(B) Cost of Trading (Weight 28%)

(C) Variety of Trading Options (Weight 26%)

(D) Technological Efficiency (Weight 20%)

THE 4-FACTOR RATING MODEL EXPLAINED

Here is the full analysis of every one of the four (4) rating factors and all of their rating sub-factors.

FACTOR-A: Safety of Funds, Weight 26%

Most Financial Entities worldwide tend to accept more risk than they can afford to handle. This is happening as the Management Fees and Management Bonuses (stock options etc.) are based on the Marginal Potential Profit and not on the Marginal Incorporated Risk. Historically speaking, financial companies tend to accept high levels of risk and to be exposed to a high likelihood of total collapse. Evidence comes from the financial crisis of 2007-2008, originally in the US and after in the rest of the world.

The Rating Factor-A incorporates several sub-factors that are designed to evaluate the ability of a brokerage company to protect and ensure its client funds. For example, the Formula rates the level of the company’s regulation, the country of the company’s headquarters base, and the ability of the company to offer segregated client bank accounts. The maximum weight of Factor A is 26.0%.

CONTRARIAN TRADING

The general goal of a Contrarian Trader is to buy under-performing assets and to sell over-performing assets.

What is the Contrarian Trading?

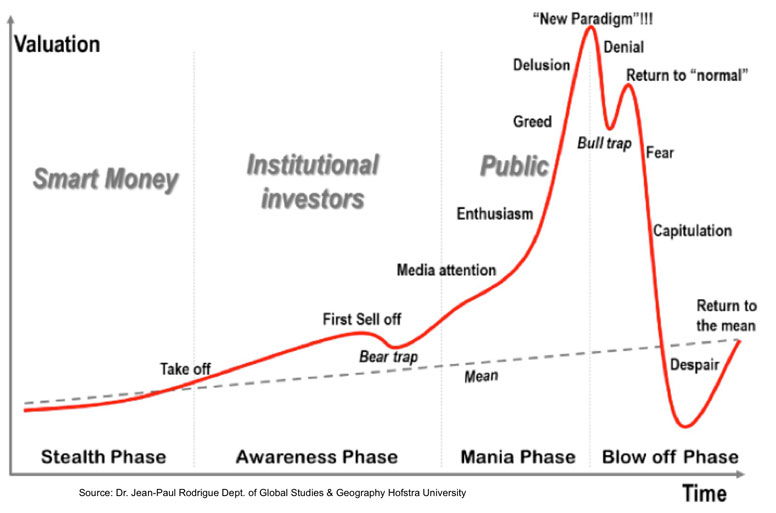

Contrarian Trading means betting on the opposite side of the prevailing market trend. A contrarian trader is based on the belief that the mass is usually wrong about how the market is going to perform. In other words, he claims that the majority of traders tend to buy the market at its peak or to sell the market at its bottom. For all those experienced with trading, this is not far from reality.

What is the goal of a Contrarian Trader?

The general goal of a Contrarian Trader is to buy underperforming assets and to sell over-performing assets. Given neutral news most of the times the under-performing assets will go up and the over-performing assets will go down.

Contrarian Strategy and Forex Trading

When a trader opens a long/short position in the Forex market forecasts that more traders will be tempted to open positions in the same direction in the near future. But the market is not driven by retail traders it is driven by major institutional traders. Retail traders tend to open positions that are not followed by institutional traders. Institutional traders tend to trade against the masses. So the key for a contrarian trader is to think like an institutional player, not a retail one. But let’s see a broader approach to the contrarian strategy.

Going the other Way of the Diminishing Demand

If most market participants believe that the price of an asset will rise then they already bought that asset. At a certain point, the demand equals the supply. After that point, the demand is diminishing while the supply remains stable so the price of this asset will consequently fell. This situation is particularly true after a news release. Contrarian traders are using a wide selection of market sentiment indicators to define how the mass is trading. Below in this article, you can find a list of market sentiment tools and indicators.

The Human Psychology

Our human nature is based on prehistoric instincts, fear and greed are two of them. Traders have the tendency to become greed at the peak of the market and to be feared close to the market’s bottom.

◙ Buy when other traders are feeling fear and sell when other traders are greed

Baron Rothschild sometime said "The time to buy is when there's blood in the streets".

CFD Trading Tutorial & Tips

What is it about?

A CFD is a financial instrument that allows investors to speculate on the global financial markets. The underlying asset of a CFD can be a Forex currency, an index, a stock, or even a cryptocurrency asset. CFDs are able to mirror the price fluctuations of any market by allowing investors to trade in both directions.

CFD trading offers some unique advantages to world traders. However, there are also some disadvantages. For example, carry traders and scalpers cannot implement their strategies by using CFDs.

Selecting the right CFD broker is very important, as there can be significant differences between the trading conditions of different CFD brokers.

Forex Trading Tips

Trading the Foreign Exchange means buying a currency and at the same selling another. There are hundreds of reasons for a currency to appreciate or to depreciate against another currency. In this truly complex and dynamic trading environment these are some important tips for all Forex traders.